A dividend stock refers to a company that is known to regularly reward their shareholders with a fraction of their profits on a monthly, quarterly, semi-annually or sometimes even a yearly basis.

Dividend paying companies provide a steady stream of income to shareholders, and many still offer the potential for stock price appreciation. Stability and income generation has always remained a top priority for many investors.

Given ongoing economic uncertainty, investors hunt for dividend-paying stocks that are undervalued, as only companies that have quality fundamentals and a robust foundation have the financial stability to maintain their dividends during questionable economic periods.

Another great aspect of adding dividend stocks to one’s portfolio is the ability to reinvest any dividends paid out by a company, using them to buy more shares (sometimes called ‘DRIP’), and taking advantage of compounding returns.

Best Dividend Stocks January 2026

| Company Name | Stock Symbol | Dividend Yield | P/E Ratio | Dividend CAGR |

|---|---|---|---|---|

| Regions Financial Corporation | RF | 3.7% | 12.3x | 10.0% |

| Sirius XM Holdings Inc. | SIRI | 5.0% | 7.3x | 15.2% |

| Nexstar Media Group, Inc. | NXST | 3.6% | 12.5x | 30.3% |

| Frontline Plc | FRO | 3.5% | 22.1x | 27.7% |

| Robert Half Inc. | RHI | 8.5% | 17.9x | 11.3% |

| DHT Holdings, Inc. | DHT | 6.0% | 9.7x | 34.5% |

| Fresh Del Monte Produce Inc | FDP | 3.4% | 21.2x | 25.6% |

| The Wendy’s Company | WEN | 6.6% | 8.6x | 15.8% |

Why We Picked These Dividend Stocks

The dividend stocks that have been screened and included in the list below show solid, consistent dividend prospects, strong fundamentals, long profit histories and strong credit ratings. We want to show investors that the best dividend stocks available for trading often still have room to run, while also hedging against too much volatility and generating additional compoundable (when reinvested) income.

The numbered list of such top dividend companies are displayed below:

- Market Cap: $24.789 billion

- Fair Value: $31.41

- Fair Value Upside: 9.4%

Regions Financial Corporation is an American bank holding company, founded in 1971 with headquarters located in Birmingham, Alabama. It operates through three segments: Corporate Bank, Consumer Bank, and Wealth Management. The banking company is the largest deposit holder in Alabama and Tennessee.

- Market Cap: $7.101 billion

- Fair Value: $28.43

- Fair Value Upside: 31.5%

SiriusXM is the leading audio entertainment company in North America with a portfolio of audio businesses including its flagship subscription entertainment service SiriusXM. Headquartered in Midtown Manhattan, New York City, it provides satellite radio and online radio services operating in the United States.

- Market Cap: $6.373 billion

- Fair Value: $227.73

- Fair Value Upside: 10.2%

Nexstar Media Group, Inc. is a leading diversified media company which produces and distributes engaging local as well as national news, sports and entertainment content across its television and digital platforms. It includes over 310,000 hours of programming produced annually by its business units.

Headquartered in Irving, Texas, Midtown Manhattan, and Chicago, Nexstar owns America’s largest local broadcasting group of top network affiliates, with 200 owned or partner stations in 116 U.S. markets reaching 220 million people.

- Market Cap: $4.628 billion

- Fair Value: $24.76

- Fair Value Upside: 14.6%

Frontline plc, a shipping company, engages in the ownership and operation of oil and product tankers worldwide. The company owns and operates oil and product tankers. As of December 31, 2024, it operated a fleet of 81 vessels, including 41 VLCCs, 22 Suezmax tankers, and 18 LR2/Aframax tankers. The company is also involved in the charter, purchase, and sale of vessels. Frontline plc was founded in 1985 and is based in Limassol, Cyprus.

- Market Cap: $2.673 billion

- Fair Value: $36.27

- Fair Value Upside: 30.0%

Robert Half Inc. provides talent solutions and business consulting services in the United States and internationally. The company operates through Contract Talent Solutions, Permanent Placement Talent Solutions, and Protiviti segments. The company was formerly known as Robert Half International Inc. and changed its name to Robert Half Inc. in July 2023. Robert Half Inc. was founded in 1948 and is headquartered in Menlo Park, California.

- Market Cap: $1.872 billion

- Fair Value: $13.77

- Fair Value Upside: 14.6%

DHT Holdings, Inc., through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, and Norway. The company also offers technical management services. As of March 15, 2024, it had a fleet of 24 very large crude carriers. The company was incorporated in 2005 and is headquartered in Hamilton, Bermuda.

- Market Cap: $1.661 billion

- Fair Value: $40.82

- Fair Value Upside: 16.3%

Fresh Del Monte Produce Inc., through its subsidiaries, produces, markets, and distributes fresh and fresh-cut fruits and vegetables in North America, Central America, South America, Europe, the Middle East, Africa, Asia, and internationally. It markets and distributes its products to retail stores, club stores, convenience stores, wholesalers, distributors, and food service operators. Fresh Del Monte Produce Inc. was founded in 1886 and is based in George Town, Cayman Islands.

- Market Cap: 1.544 billion

- Fair Value: $9.89

- Fair Value Upside: 17.2%

The Wendy’s Company (WEN) is a well-known American fast-food restaurant chain founded in 1969 by Dave Thomas. Wendy’s is famous for its square hamburgers, sea salt fries, and the Frosty, a signature frozen dairy dessert. Headquartered in Dublin, Ohio, Wendy’s operates a global network of company-owned and franchised stores.

How to Find The Best Dividend Stocks

To start, we focused only on those U.S. stocks that have a market capitalization exceeding $1 billion as well as a significant market share, while presenting stable financial conditions for continuing the growth of their dividend payouts regardless of ongoing macro conditions.

In order to guarantee that we are not buying stocks that are already extremely expensive, a fair value assessment filter was added in the InvestingPro screener, which shows only those stocks that have growth potential going forward, thereby avoiding risks of a sudden, big drop in share price.

Further, a filter for dividend compound annual growth rate (CAGR) of 5 years has also been incorporated in our stock screening criteria, which curates a list of only those companies that are consistently growing their payout ratios at 10% or more.

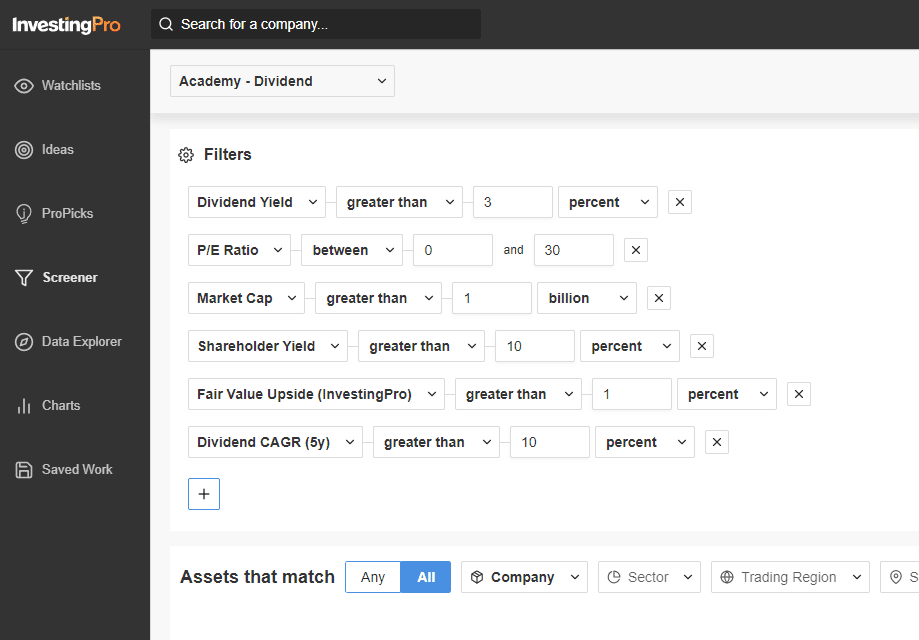

Here are the steps to finding top U.S.-based dividend stocks easily using Investing Pro:

- Click on the Screener tool.

- Select ‘Dividend Yield’ as a filter parameter on the Screener page, and set the threshold value to greater than 3%.

- Add a P/E Ratio filter and set the range between 0 and 30x.

- Add a further four metrics: Market Cap, Shareholder Yield, Fair Value Upside and Dividend CAGR (5y), setting their range to desired values. You can also follow our stock selection metrics as shown in the screenshot below.

- For U.S.-centric stocks, select ‘United States’ under the ‘Trading Region’ tab drop-down, and make sure to check (select) the ‘Primary Trading Item’ option.

- You can then see the list of all the companies falling in the desired screener filters’ range arranged in a descending order.

🧮 Try Our Dividend Calculators Today!

Get ahead with our powerful tools:

📈 Dividend Returns Calculator – See how your investments can grow

💹 Dividend Yield Calculator – Find dividend yields easily