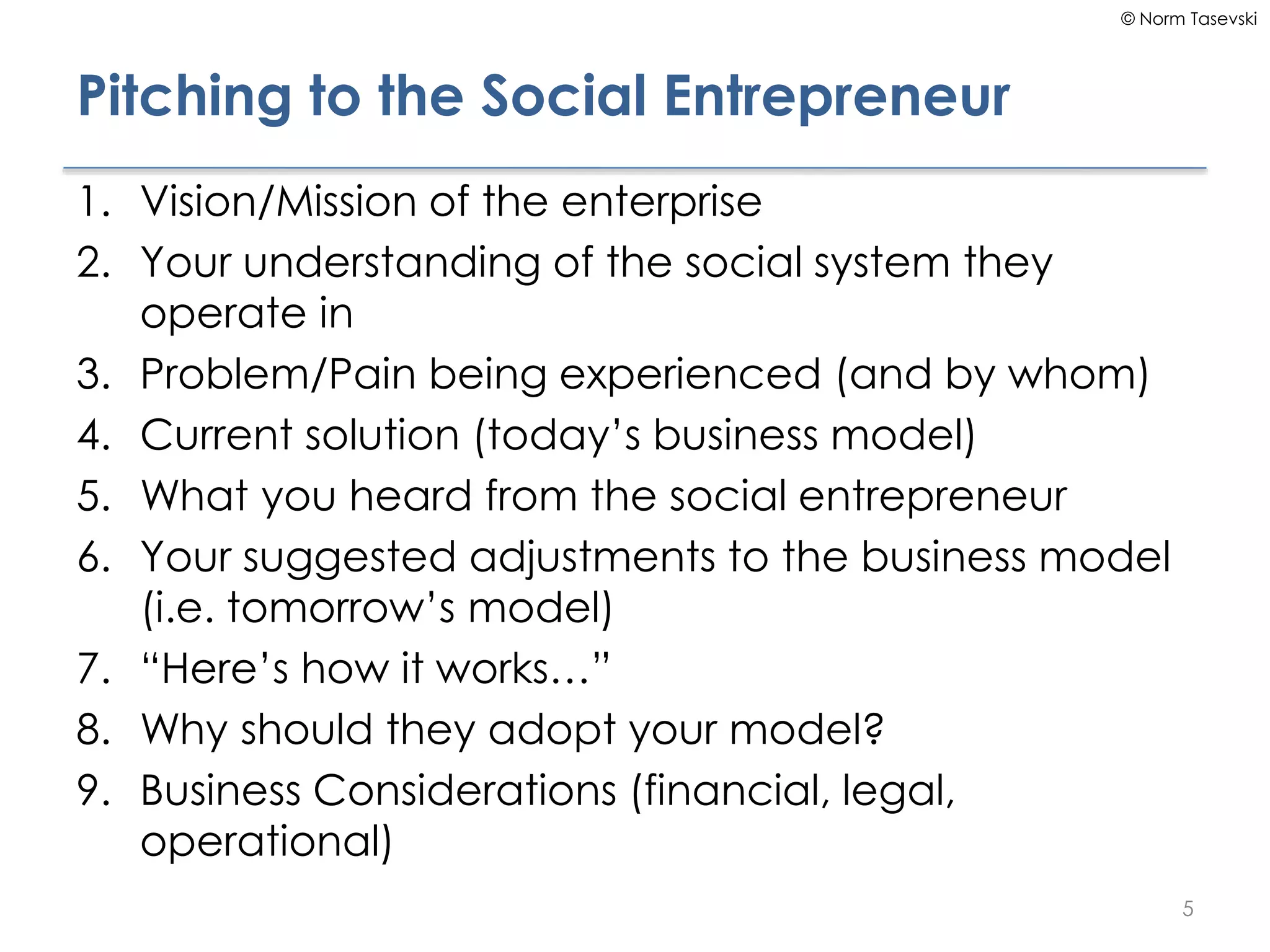

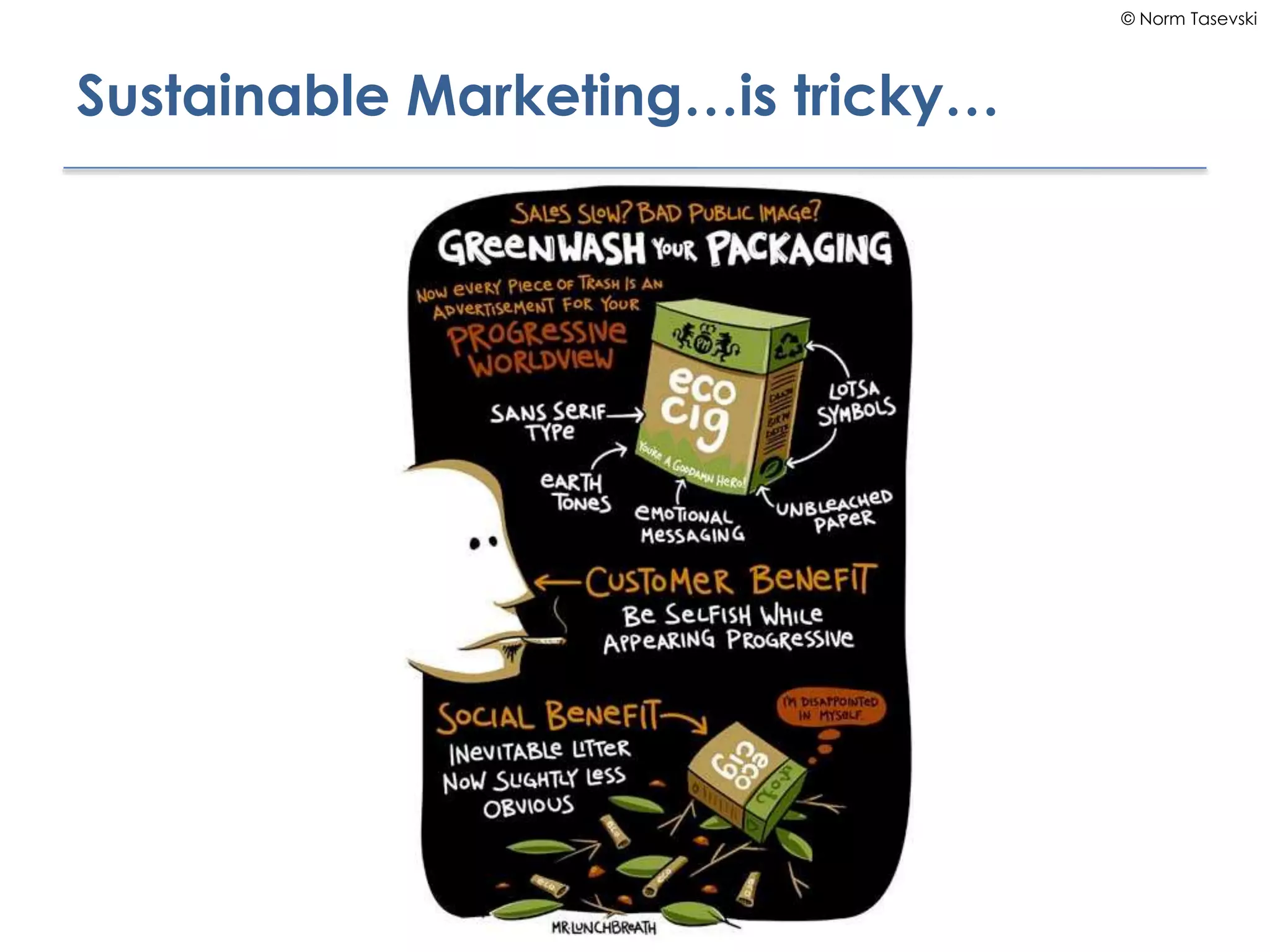

This document summarizes a class on considerations for social enterprises. It includes the agenda, which covers marketing, operational considerations, and legal considerations for social enterprises. The document provides guidelines for student presentations on business cases, including the required components and time allotment. It also gives examples of pitching a social enterprise business model. Finally, it discusses considerations for marketing, human resources, operations, and different legal forms for social enterprises.