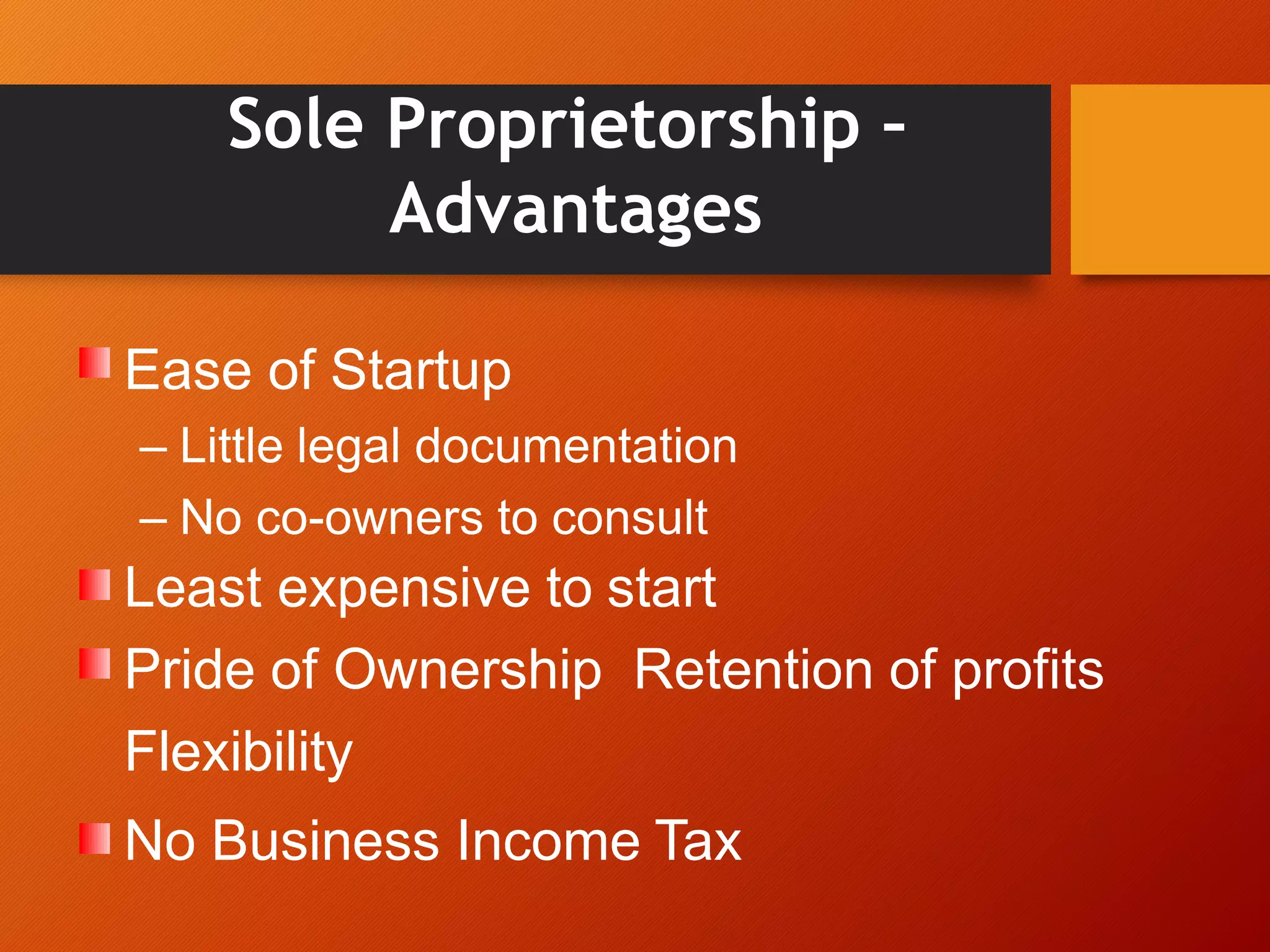

The document outlines various business functions and organizational structures. It discusses key areas like human resources, sales, marketing, R&D, production, finance, and administration. It also covers topics such as business organization charts, legal forms of business like sole proprietorships and corporations, and concepts like franchising and mergers & acquisitions.