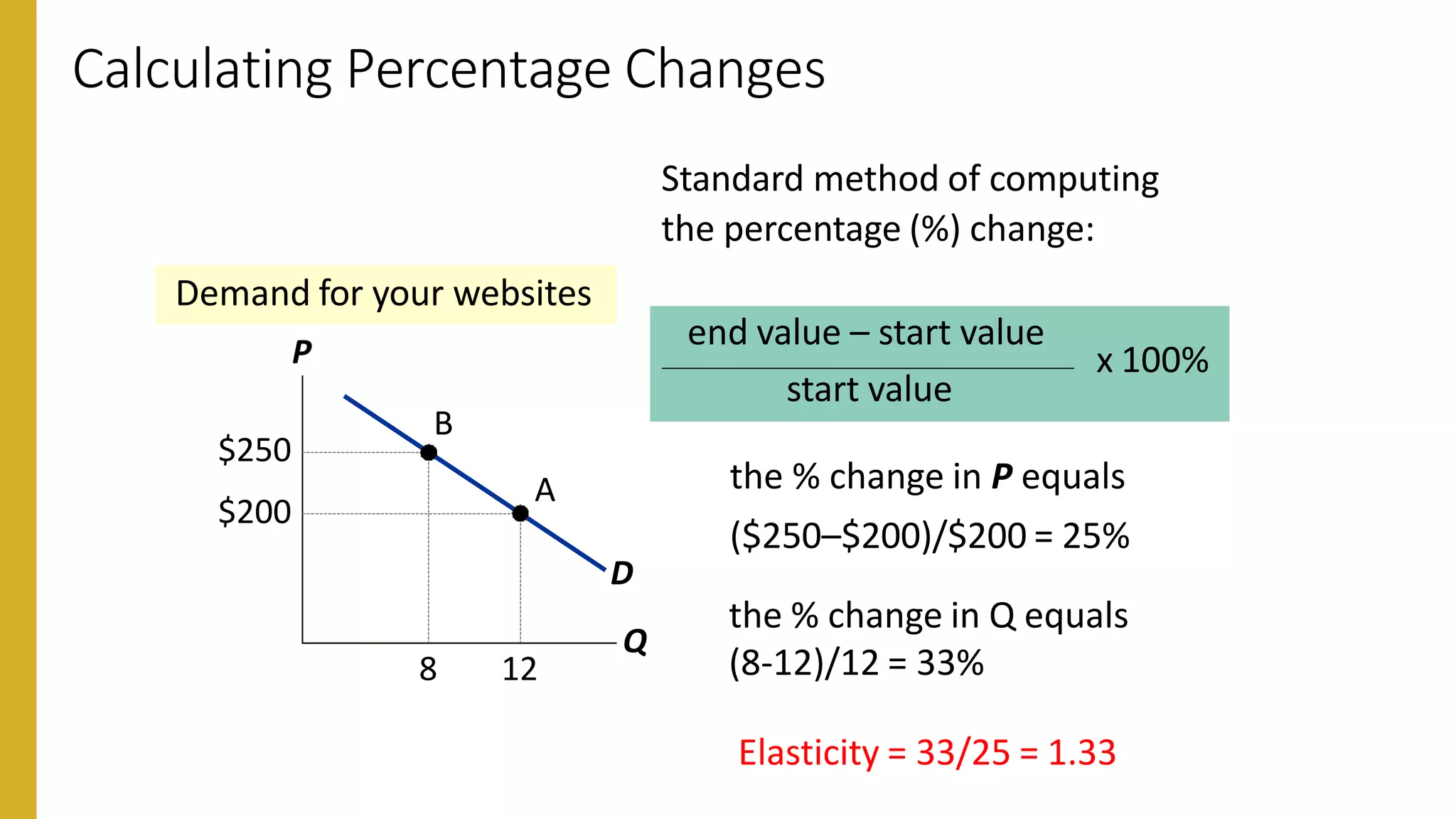

If the website designer raises their price from $200 to $250 per website, total revenue would fall. Demand for websites is elastic, so quantity demanded would fall more than the 25% price increase. Specifically, quantity demanded would fall from 12 websites per month to 8. While the higher price increases revenue per website, the larger drop in quantity sold means total revenue falls from $2,400 to $2,000.