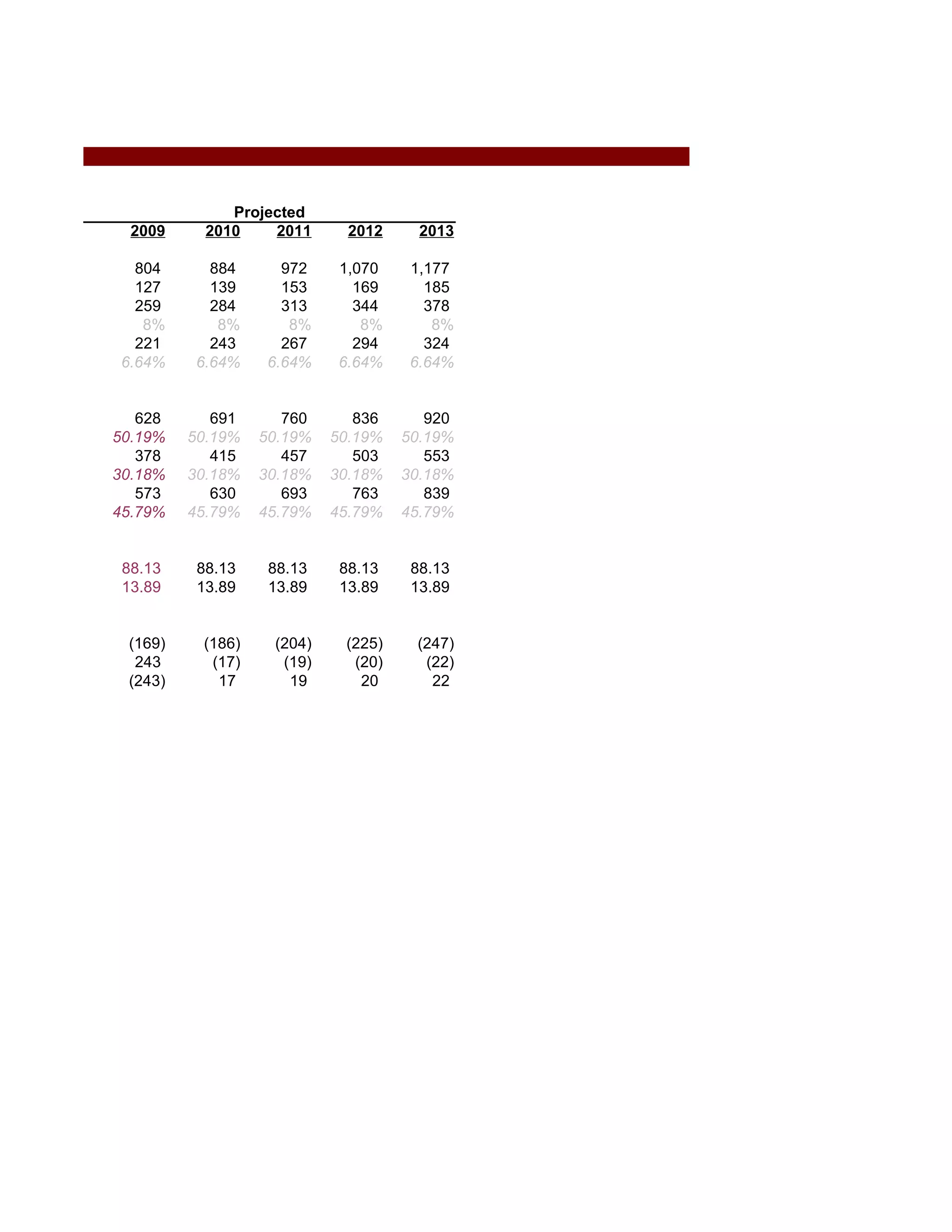

This document contains an analysis of Activision Blizzard using a discounted cash flow valuation model. It projects revenue, costs, earnings, and cash flows for Activision Blizzard through 2013 and estimates a terminal value and enterprise value of $18.1 billion. This results in a projected share price of $13.87, higher than the current price of $10.87. The analysis assumes long-term revenue growth rates of 10% for product sales and subscriptions. A terminal growth rate of 5% and discount rate of 8.18% are used to calculate the terminal and net present values.