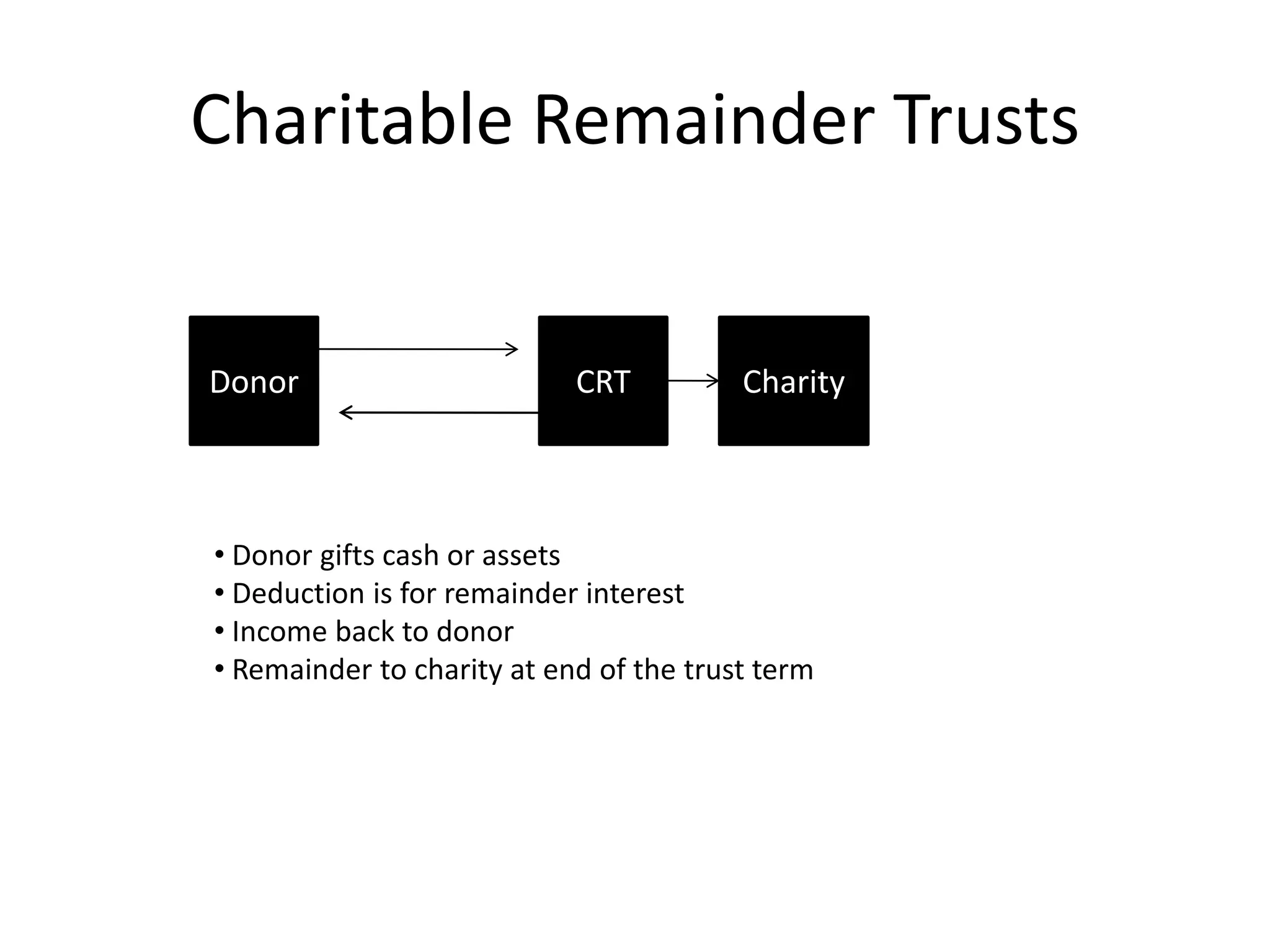

The document provides an overview of planned giving strategies for donors, including bequests, life insurance, retirement accounts, real estate, charitable remainder trusts, charitable gift annuities, and charitable lead trusts. It discusses the basics of how these different planned giving tools work, their tax implications, and why donors may want to utilize them to combine their charitable, family, and financial goals.