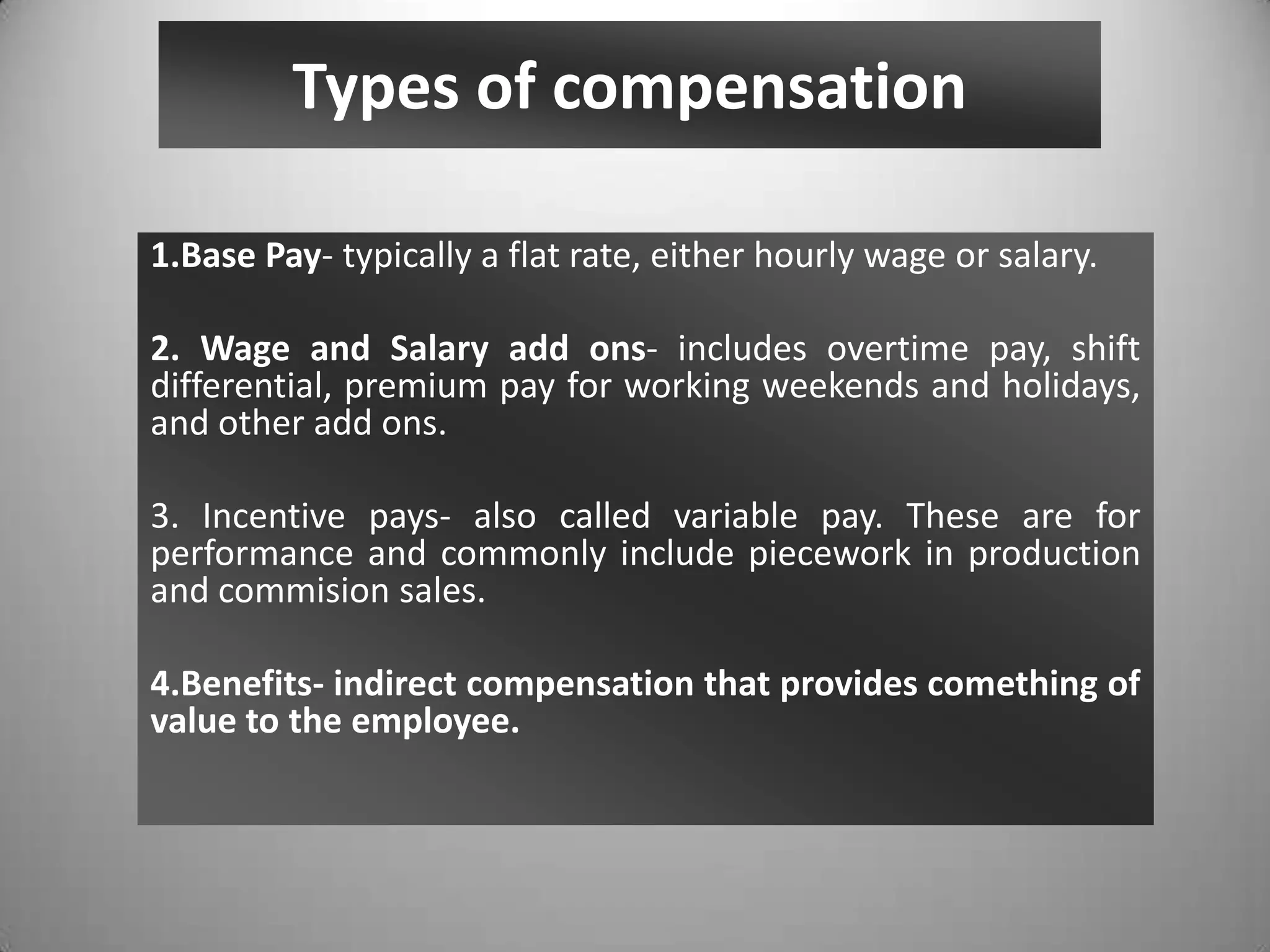

This document discusses compensation and employee benefits. It defines compensation as remuneration received by employees in exchange for their contributions. Compensation management is part of human resource management and helps motivate employees. There are different types of compensation including base pay, incentives, and benefits. Benefits provide indirect value to employees and include legally required programs as well as voluntary benefits provided by employers. The document outlines considerations for establishing compensation and benefit programs.