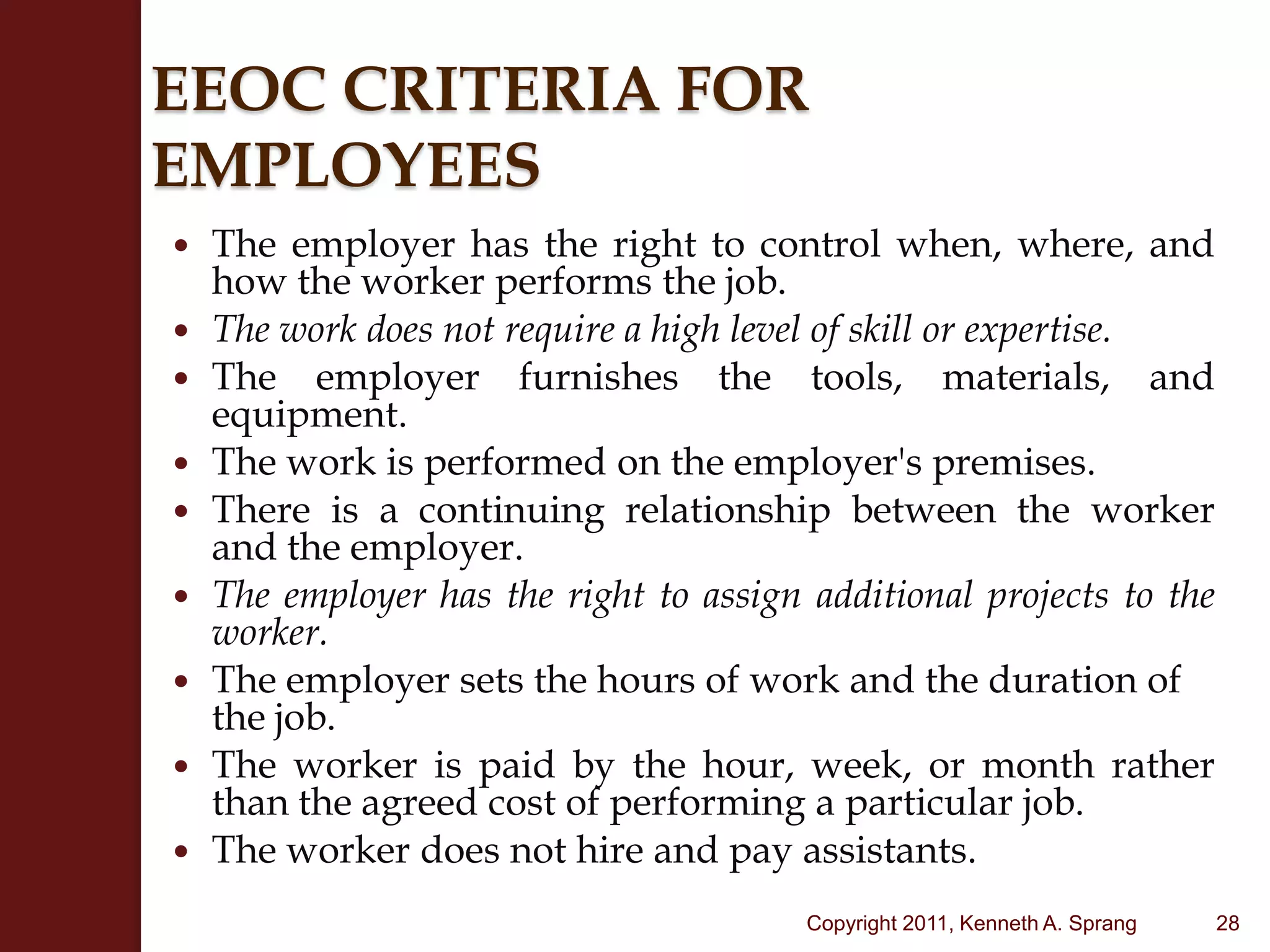

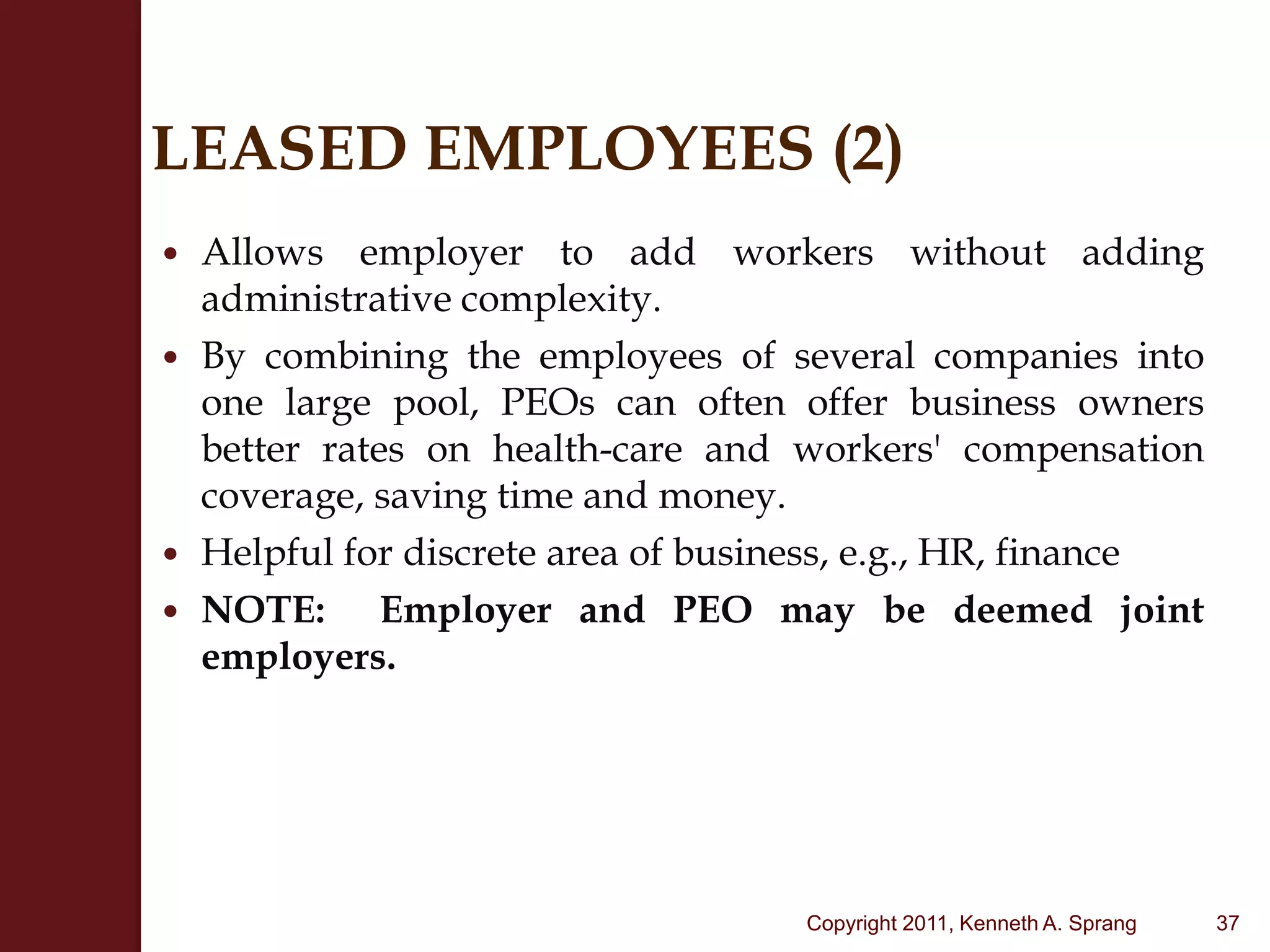

The document outlines the guidelines distinguishing independent contractors from employees, emphasizing compliance with IRS and Department of Labor regulations. It details factors affecting classification such as control, relationship duration, payment structure, and benefits, along with specific examples and exceptions. Misclassification can lead to significant legal and financial repercussions for employers, highlighting the importance of proper classification in business operations.