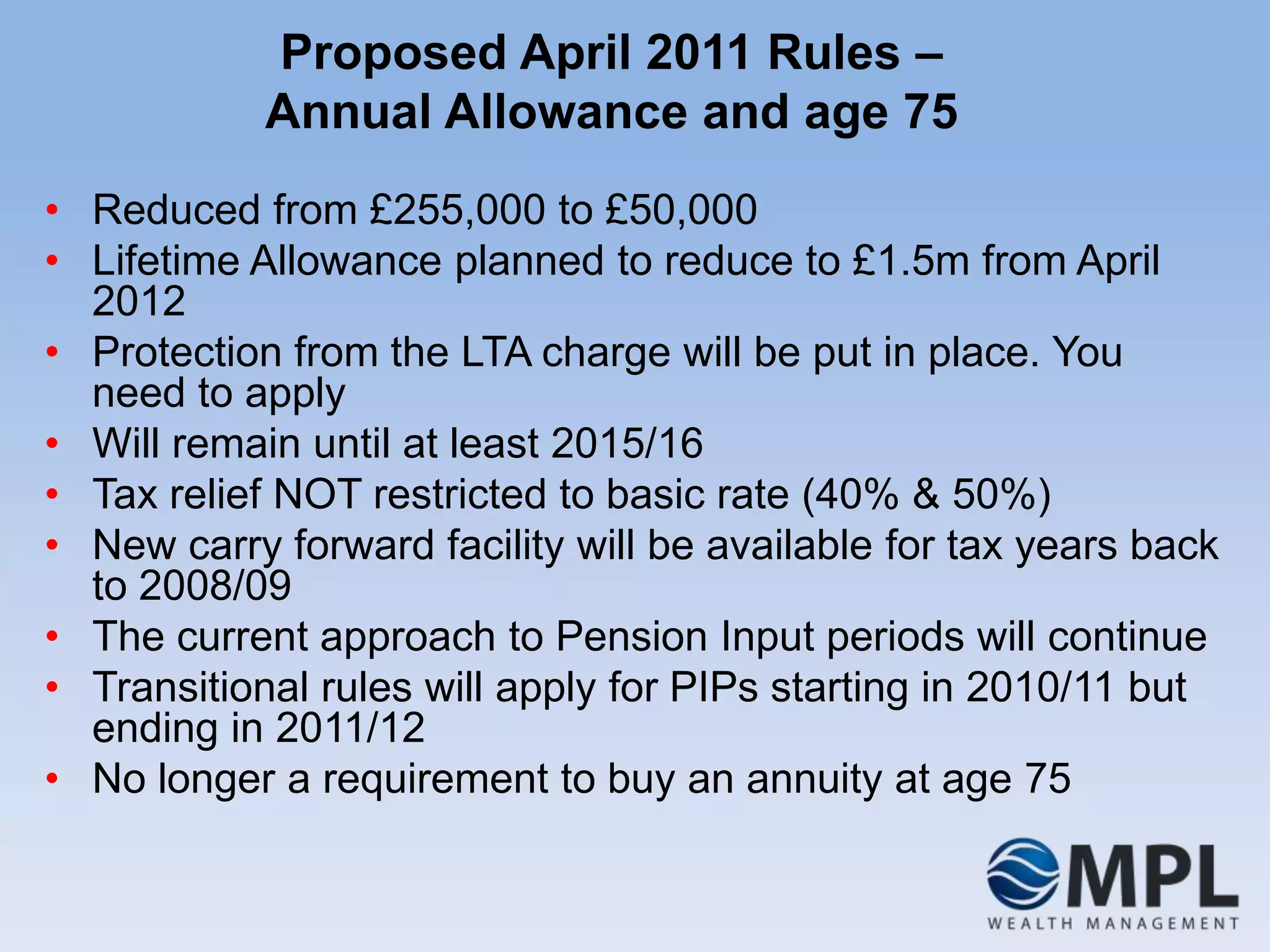

The document outlines significant changes to pensions in 2011, including a reduction of the annual allowance to £50,000 and a planned decrease in the lifetime allowance to £1.5 million from April 2012. It highlights the ability to carry forward unused annual allowances from up to three previous tax years and eliminates the requirement to purchase an annuity at age 75. Additionally, tax relief will be available at the individual's highest marginal rate, subject to specific regulations and conditions.