The document outlines a presentation on Takaful (Islamic insurance). It includes:

1. An introduction to Takaful, its characteristics including separate funds and equal surplus distribution.

2. An explanation of why conventional insurance is not halal and the differences between it and Takaful.

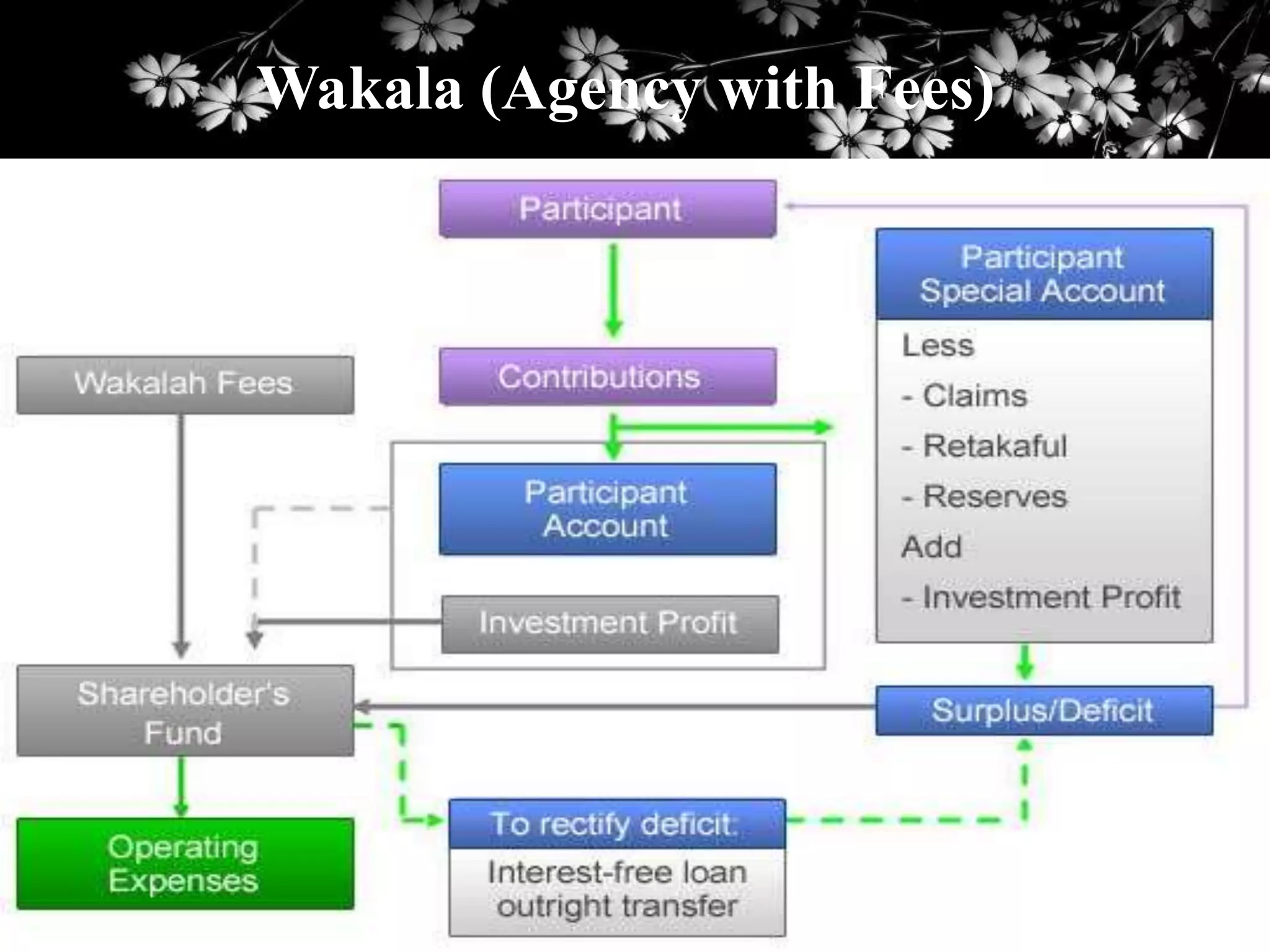

3. Details on the various models of Takaful including Mudarabah (profit-sharing), Wakala (agency with fees), and hybrid models.

4. A discussion of the role of Takaful in Islamic economic systems and some of the future challenges and suggested measures for the continued growth of the Takaful industry.