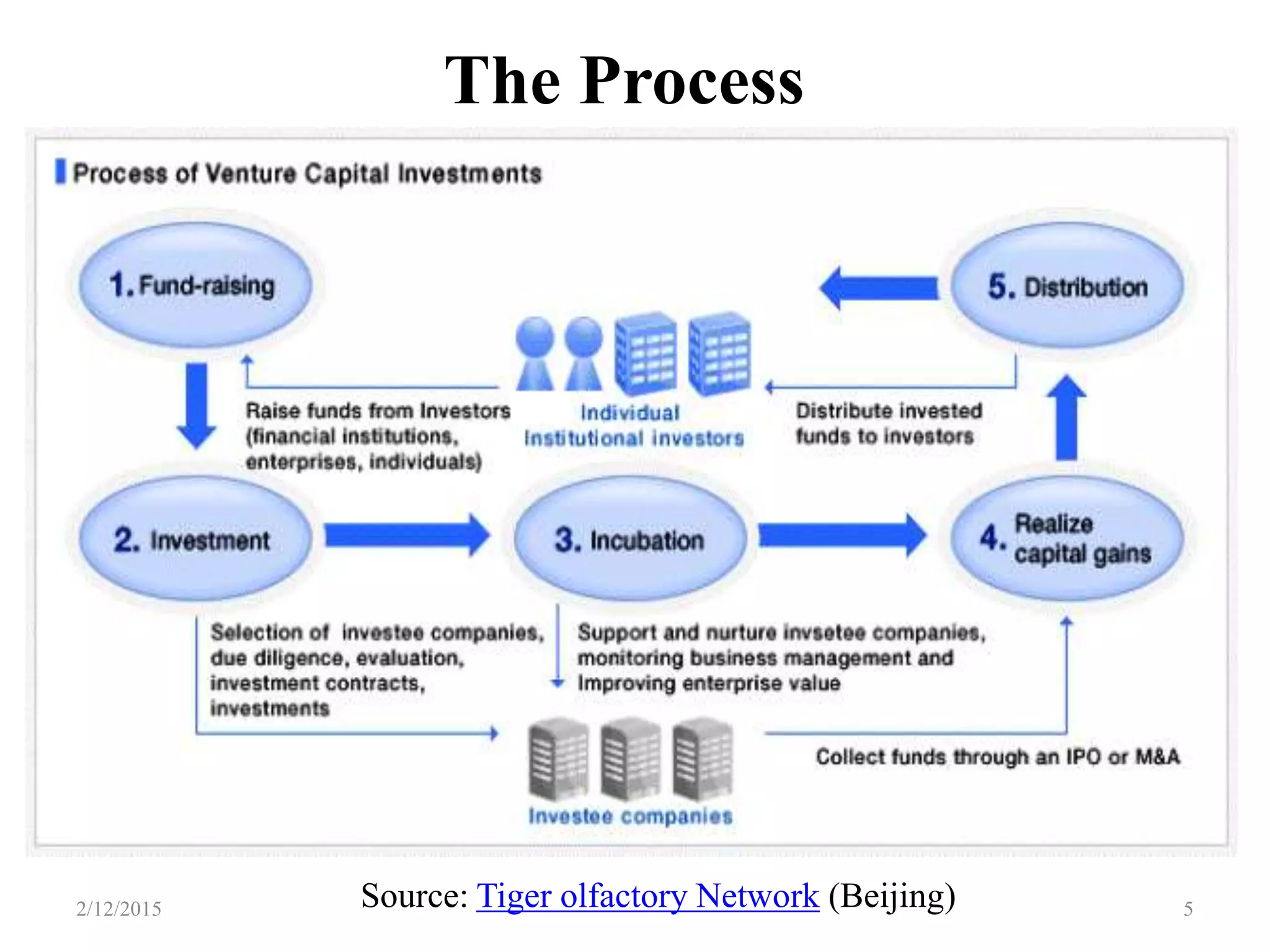

Venture capital refers to long-term risk capital provided to finance high-risk, high-growth startups. Venture capitalists are professional investors who pool resources to assist entrepreneurs in the early years of their projects. Venture capital comes in the forms of debt, equity, or preferred stock. The venture capital process involves deal origination, screening, evaluation, deal structuring, and post-investment activities like exits through IPO, mergers and acquisitions, share buybacks, or sales to strategic investors. Reliance Venture Asset Management is an example of an Indian corporate venture capital firm that follows a multi-stage investment process.